Much less-than-truckload provider Saia appears to be like to be retaining the quantity influx it received following the shutdown of Yellow.

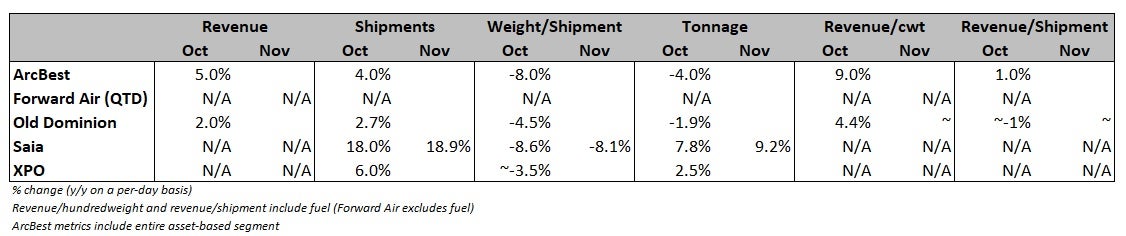

The corporate reported a 9.2% year-over-year (y/y) amplify in tonnage per day during November, which followed a 7.8% amplify in October. The acceleration became as soon as in fragment due to softer comparisons to final year. Saia recorded y/y tonnage declines of 3% and 7.1%, respectively, in October and November of 2022.

Saia’s (NASDAQ: SAIA) 2023 fourth-quarter tonnage will enhance were driven by high-formative years development in day-to-day shipments, which were partially offset by weight per shipment declines of larger than 8%.

October had some affect from a cyberattack at Estes, nonetheless, about a of the carriers that noticed a bump in volumes as a result of tournament said that the freight had flowed wait on to Estes by the end of the month.

Saia’s latest development charges imply tonnage would possibly be down by roughly 5% within the fourth quarter, which is a itsy-bitsy bit bit better than ordinary seasonality.

“While the acceleration in quantity is partly comp related (and we ask one more acceleration in December due to even simpler comps), this day’s announcement does enhance the gape that SAIA is retaining on to the majority of its market portion gains despite its focal level on stamp and profitability,” Deutsche Bank (NYSE: DB) analyst Amit Mehrotra informed customers in a Monday morning present.

Saia’s tonnage became as soon as down 13.2% y/y final December. Much less-than-truckload establish a matter to grew to change into negative at the end of the 2022 summer season with the y/y declines accelerating to end the year.

“We also didn’t detect one thing else ravishing in weight per shipment dispositions from October to November vs. what we would in total ask (down 0.6% sequentially), which further supports the gape that SAIA is retaining on to its market portion gains,” Mehrotra persisted. “December volumes might possibly also be indispensable, given the company’s GRI [general rate increase] takes tag this day (December 4).”

Yellow’s exit has induced some carriers to implement annual GRIs sooner than time desk. Saia’s latest announcement of a 7.5% amplify became as soon as 100 basis positive aspects higher than its prior GRI and the implementation came two months earlier.

Saia noticed the largest sequential amplify in shipments amongst publicly traded carriers throughout the third quarter, the main reporting length following Yellow’s collapse. Saia spoke back by including larger than 1,000 workers to its existing head depend of roughly 12,000. It has also been including terminals and tools in clear markets to accommodate the portion wins.

Throughout the third quarter, Saia’s tonnage per day became as soon as up 6.7% y/y as shipments increased 12.2% and weight per shipment became as soon as down 5%. The corporate doesn’t inform yield metrics in its intraquarter updates nonetheless earnings per hundredweight excluding gasoline surcharges became as soon as 8.4% higher y/y within the third quarter.

The broader industrial complex, which generates roughly two-thirds of the freight moved via LTL networks, remains in decline. The Manufacturing Shopping Managers’ Index remained unchanged at 46.7 during November and beneath the just threshold of 50 for a 13th straight month. The fresh orders factor of the index did pork up 2.8 positive aspects to forty eight.3.

Smooth establish a matter to at some level of the business sector has been a indispensable headwind for LTL shipment weights.

More FreightWaves articles by Todd Maiden

- Public sale for Yellow’s terminals ‘remains ongoing’

- Lineage Logistics reported to be pursuing $30B-plus IPO

- Forward Air, Omni pointing fingers over EBITDA forecasts