As provide chain disruptions depart, the US East Soar and Gulf Soar port strike – which began at the present time – used to be one of many more predictable. Threats to US port operations seesaw from one aspect of the nation to the varied on a six-yearly cycle as collective labor contracts grind toward expiry dates and efforts to barter contemporary ones fling on for months without success.

Two years ago, uncertainty shrouded the West Soar, the place the Pacific Maritime Association (an organization representing employers within the transport replace) and the Worldwide Longshore and Warehouse Union (ILWU), representing 22,000 dockworkers, took more than a 365 days to finally hammer out a recent deal.

This time around, it’s the flip of the Worldwide Longshoremen’s Association (ILA) and 45,000 of its participants at ports much like Original York-Original Jersey, Savannah, and Houston to rock the boat. ILA president Harold Daggett began warning of the likelihood of a strike as a ways assist as November 2023 if bosses at the United States Maritime Alliance (USMX) did now not fulfill the union’s question for a 77% pay upward push.

“Identified Identified” dangers

In provide chain likelihood terms, US port strikes comprise change into what the worn Secretary of Defense Donald Rumsfeld famously known as a “known known.” Now not like “known unknowns” or “unknown unknowns” (most incessantly is named “Murky Swans”), these are likelihood occasions for which the timing and walk penalties are effectively understood and hence is also planned for.

The “Rumsfeld Matrix”

Whereas the pronounce length and buck affect of a port strike can’t be known prematurely, previous ride does provide some pointers. The closing West Soar strike in 2015 lasted eight days and price the Southern Californian economy by myself an estimated $8 billion. The closing East Soar strike in 1977 ran for 60 days with economic costs reckoned to be in way over $1 billion per week nationwide. Backlogs, when it involves the quantity of days’ delay in unloading ships per day of strike action, can additionally be estimated with an reasonably priced level of accuracy.

Monetary losses will unquestionably be higher this time around, if finest as a consequence of inflation all the way thru the nearly half-century since – although per chance no longer as dramatic because the $5 billion per day that JP Morgan has forecast. As for length, Lee Klaskow, Bloomberg Intelligence Transportation and Logistics Analyst, anticipates a two-week strike at the 36 ports affected, with a “fling on economic growth” the critical affect. (Klaskow is presenting on the worldwide replace outlook to Zero100 participants next week.)

One vivid verbalize: container transport rates, which skyrocketed all the way thru the Covid-19 pandemic, are inclined to be finest “marginally affected” by the strike, in step with replace experts.

Switching Cargoes From East to West

With the finest thing about long lead times, many US retail and manufacturing companies were readying themselves for port closures, delays, and backlogs on the Jap seaboard since early 2024. Relief in January, gathered for a Zero100 roundtable, more than a dozen logistics leaders had been more livid by the threat of an East Soar port strike than the threat of drone and missile strikes on ships within the Red Sea.

At a observe-up session in March, the senior logistics director at one US apparel and shoes company mentioned that if talks between the ILA and USMX did now not yield progress by the summer season, it would per chance well beginning up diverting shipments to the West Soar.

Re-routing ocean-walk goods to ports unaffected by doubtless strike action – alongside with building up inventories, importing seasonal items much like Christmas holiday gifts early, and engrossing top class and perishable merchandise to airfreight – is what any proactive provide chain likelihood and resilience technique would dictate.

It’s unsurprising, then, that in present months, the tip 5 West Soar ports comprise considered their fragment of container import web site visitors overtake that of the finest East Soar and Gulf Soar ports – a reversal of the sphere in 2022-23 when industrial unrest loomed over the Western seaboard. Total assignment at the Port of Los Angeles, shall we assert, used to be up 17.4% 365 days on 365 days thru August, in contrast with a 13% lower in 2023.

Automation? Now not if It Displaces Jobs

Alternatively, the West Soar ports’ advantage would per chance be short-lived. One reason for here is that East Soar and Gulf Soar ports are more atmosphere friendly, in step with the most standard Container Port Efficiency Index. This reveals that the tip quartile of performers includes eight ports on the East and Gulf Coasts (in conjunction with Original York-Original Jersey), while seven of the 11 North American ports within the underside quartile are on the West Soar (in conjunction with LA/Prolonged Seashore). However East Soar and Gulf Soar ports shouldn’t be too smug. Correct as with the ILWU’s Luddite-cherish stance, the ILA continues to strongly withstand the introduction of most standard technology, much like driverless vehicles, computerized cranes, and even semi-computerized gates at terminal entrances. Its staunch-expired contract stipulated a joint committee with equal employer and union illustration to approve any such technology, and the ILA says it walked out of talks in June because it had proof this used to be being flouted at some ports.

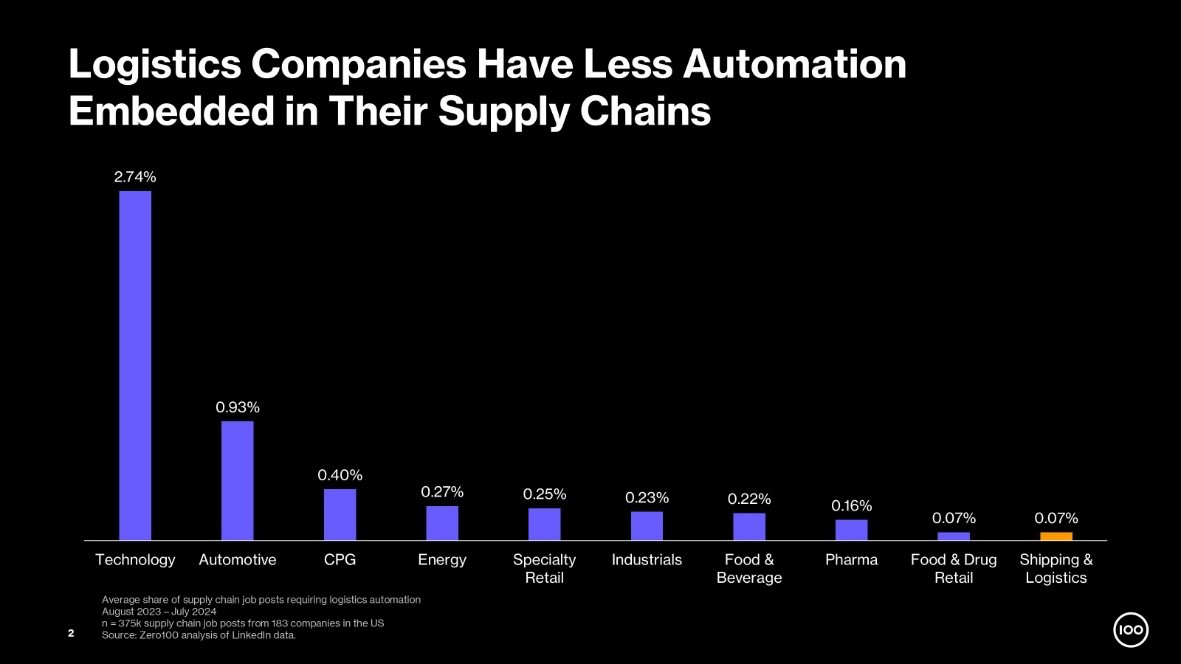

The dearth of investment in productiveness-bettering technology appears to be like to be an replace-huge field. Zero100 prognosis of provide chain job postings by US companies between August 2023 and July 2024 reveals that transport and logistics companies lagged within the assist of their peers within the excessive-tech, car, CPG, and varied sectors in shopping for workers equipped to address a range of computerized and self sustaining techniques and self-riding vehicles.

The likelihood of a recent long-term agreement between the ILA and the USMX altering this dynamic appears to be like as a ways away as loads of the ports from which US-walk shipments make. And while the digitization recount stays unresolved, the cycle of predictable disruptions at US ports is determined to continue.