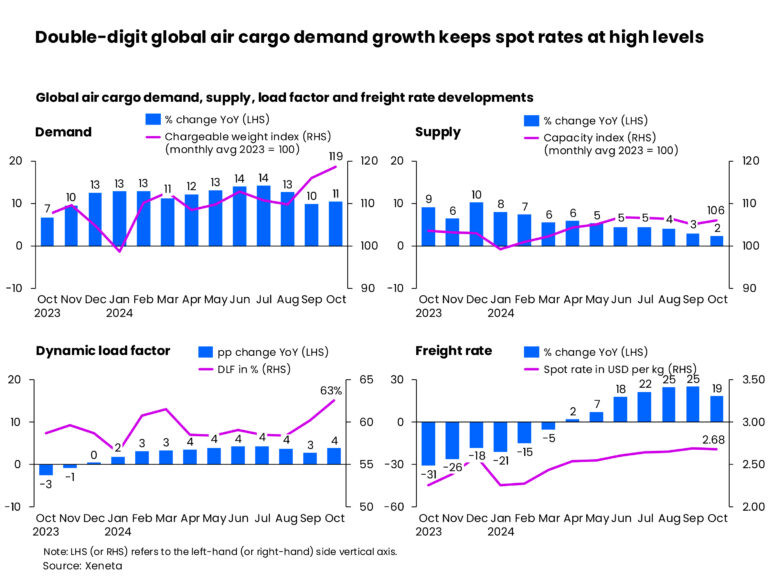

Not even zero enhance in November and December can disrupt the area air cargo market from landing a 12 months of peculiar double-digit query enhance in 2024. Wholesome volumes of +11 p.c in October and blueprint rates up +19 p.c 12 months-on-12 months reflected the rising maturity and steadiness among shoppers and sellers of air cargo skill, in response to essentially the most modern market records by Xeneta.

A 12 months of fixed, surprising disruptions out of doorways of the industry’s support a watch on – which started with a enhance forecast as per October 2023 of +1-2 p.c for the chubby 2024 – is now firmly on word to cease on a high when it involves query. Such stipulations historically result in winners and losers, nonetheless lessons realized and utilized by shippers, freight forwarders, and airways “shows the industry at its most efficient,” says Niall van de Wouw, Xeneta’s Chief Airfreight Officer.

“The frequency and diversity of ‘storms’ coming the technique of the air cargo industry in 2024 mean this 12 months might well well additionally were somewhat messy, nonetheless the industry has discovered a technique to navigate these challenges,” he acknowledged. “This shows the prep work has paid off as well because the flexibility shown within the industry. We inquire more emphasis on striking forward relationships than squeezing every last dime of income.”

While October’s world air cargo blueprint rate persevered to place elevated – averaging USD 2.68 per kg and appropriate just a few cents below 2023’s top season high – the growth momentum slowed down from +25 p.c in September, due mostly to a high comparison shameful in October 2023. By technique of the month-on-month model, October’s blueprint rate became as soon as rather flat in contrast with September.

The elevated 12 months-on-12 months enhance blueprint rate became as soon as supported by persevered double-digit enhance (+11 p.c) in world query, measured in chargeable weight. Compared, world cargo skill offer edged up only 2% p.c 12 months-on-12 months.

This offer and query imbalance pushed the dynamic load factor up 4 share aspects to 63 p.c in October. Dynamic load factor is Xeneta’s dimension of skill utilisation in response to volume and weight of cargo flown alongside accessible skill.

Zooming into the corridor stage, Europe to North America saw essentially the critical month-on-month volume prolong of +11 p.c. The return leg also saw a +10 p.c month-on-month prolong as shippers and forwarders took precautionary measures to reduce the influence of the 3-day strike by dockworkers at US East Flit and Gulf Flit ports. A sooner-than-anticipated decision to this industrial inch, nonetheless, saw the sure influence of the strike on air cargo volumes ebb away after reaching a top within the week ending 20 October. On the other hand, the upward push on this corridor’s air cargo rates is at risk of continue after airways diminished cargo skill at the cease of the month to designate the open of chilly climate schedules.

Skill historically shifts to corridors generating better revenues, which results in a more balanced air cargo offer and query. Consequently, blueprint rates from Northeast Asia to North America, a top fronthaul corridor, stayed rather flat month-on-month – in fraction attributable to a cooling down after a September enhance triggered by coarse climate disruptions and China’s Golden Week holidays.

Equally, the Northeast Asia to Europe market stayed flat in contrast with a month ago. Despite several cancelled passenger flights between Europe and China attributable to uncompetitive routings, the corridor’s air cargo skill easy rose attributable to increased freighter skill. This inflow of skill contributed to a decline in backhaul blueprint rates both month-on-month and 12 months-on-12 months.

Transferring skill to Asia from the Americas market also triggered freight rate will enhance in secondary corridors. Set rates ex South America to Europe and its return leg rose by high single digits or double-digits month-on-month.

Middle East & Central Asia to Europe blueprint rates ticked down -3 p.c month-on-month. Contributing components incorporated the easing of civil unrest in Bangladesh and subsiding climate disruptions.

“What we are seeing within the air cargo market is a praise to the rising skill of shippers, freight forwarders, and airways to administer disruptions and route of a bunch of those volumes with out as primary drama spherical spiralling rates. Over the long-time duration, this is better for all americans,” van de Wouw acknowledged.

“There’s a maturity available within the market which stems from airways being better prepared this 12 months as well as there being clearer ideas in keep between shippers and forwarders, and forwarders and airways. This is steady for relationships – and steady for shoppers. Rates are easy elevated versus a 12 months ago, nonetheless no matter solid query, rising load factor, and only a modest prolong in offer, they devise no longer seem to be going crazy. Lessons were realized and of us are attempting to search out healthy, practical rates on either aspect.

“This puts air cargo query safely on word to narrative double-digit enhance in 2024, and never even zero enhance in November or December goes to disrupt this,” he added.

The next stage of market maturity, van de Wouw says, will most certainly be indexing between shippers and forwarders the employ of a neutral third-celebration offer to adjust rates via the length of their contracts. “Indexing will income all events and make confidence to enter long-time duration contracts. It is a natural next step in a market that is clearly seeing better steadiness from better preparedness,” van de Wouw acknowledged.