The enviornment air cargo market is heading in direction of a ‘scorching Q4’ of rate will increase after a sixth straight month of double-digit remark in June, with a warning that shippers and forwarders in downhearted health-ready for this one year’s peak season would per chance per chance presumably regain themselves ‘on the mercy of the market,’ constant with the newest analysis by Xeneta.

Ask in June, measured in chargeable weight, became +13% one year-on-one year, continuing the upward model considered throughout the necessary half of 2024. In disagreement, cargo present grew at its slowest accelerate in 2024, edging up simplest +3% one year-on-one year.

READ: CALLS FOR LABOUR TO EASE BURDEN ON LOGISTICS SECTOR

As a result, the realm air cargo dynamic load facet – Xeneta’s dimension of ability utilisation essentially based on quantity and weight of cargo flown alongside on hand ability – elevated by +4% pts one year-on-one year.

Whereas June’s info, alongside previous months of annual remark, desires to be balanced towards the frail comparison considered within the corresponding months of 2023, market gamers for the time being are busy strategizing on the very best probably ways to navigate the monetary challenges and alternatives anticipated to point to themselves in Q4.

“June’s remark in query became no longer sexy and we’d per chance presumably quiz to peek a continuation of double-digit one year-on-one year remark in July and August on narrative of low query within the an identical months closing one year. The enviornment machine is humming alongside effectively at this level – however right here’s probably the serene ahead of the storm by formulation of air freight charges,” stated Niall van de Wouw, Chief Airfreight Officer at Xeneta. “I’ve heard already that sure airways and forwarders are pondering of implementing a peak season surcharge by the end of August. There’s a consensus it will be a scorching Q4 for air cargo in many Asian markets.

“We quiz decrease query remark one year-on-one year within the second half of 2024 on narrative of such a solid Q4 2023 comparison, however whenever you haven’t arranged your Q4 ability by now, you may per chance presumably be in for moderately a rush. Shippers can pay more throughout Q4, the quiz is how plan more?” he added.

READ: AIR INDIA TO PROPEL MAJOR EXPANSION IN AIR CARGO OPERATIONS

query vs. present for the closing quarter of 2024, van de Wouw stated ‘the foundations of the game are changing into determined’ and personal strict compliance stipulations. Shippers and forwarders with ability agreements in markets which would per chance per chance presumably be ‘tight’ already, essentially based on mounted volumes and a peak surcharge, will have lowered threat, while these dependent of the space market can quiz to pay ‘a hefty top rate’.

“In 2023, the market didn’t assign up for the query we saw. This one year, it does. Shippers with ability agreements in space will be better ready, however if they plod above the agreed upon threshold, they’ll face paying market charges. On the short-term space market, this would per chance per chance imply +50% will increase in charges above what we ask now, as soon as the market no doubt heats up.

“Asset holders will be strategizing; how worthy ability they’ll assign on the inspire of to sell at a top rate when this occurs. Even as you had been in an airline’s sneakers, you’d produce sure you had a staunch chunk of ability to sell on the top rate inclined to be paid on the short-term market,” van de Wouw acknowledged.

The e-commerce remark, disruptions in ocean freight attributable to warfare within the Pink Sea, and overall enhancements in world producers’ activities had been the three major pillars using up world air cargo space charges in June. These registered their greatest elevate of the one year thus a long way, climbing +17% one year-on-one year to USD 2.62 per kg.

Measured month-on-month, the air cargo space rate edged up +2% in June, as the +4% month-on-month remark of cargo query continued to outpace ability present.

Zooming into the hall level, Southeast Asia to Europe and the US markets saw the greatest cargo space rate will increase in June, increasing +14% versus Might per chance presumably presumably additionally to USD 3.65 per kg and USD 5.32 per kg respectively. Northeast Asia to Europe and the US also experienced modest space rate will increase, up +5% to USD 4.26 per kg and +4% to USD 4.00 per kg.

Conversely, outbound China markets stalled as China to Europe and the US charges every dipped -1% to USD 4.09 per kg and USD 4.80 per kg respectively. The Europe to US space rate fell -4% to USD 1.69 per kg attributable to the enhance of belly ability from summer passenger flights.

Trying ahead, many market uncertainties live. The newest manufacturing Shopping Managers’ Index (PMI) reported manufacturing production grew at a slower accelerate in June, with its subindex of contemporary export orders showing the necessary decline in three months. This coincides with peaceable-easy retail sales volumes within the US and Europe, no matter cooling inflation.

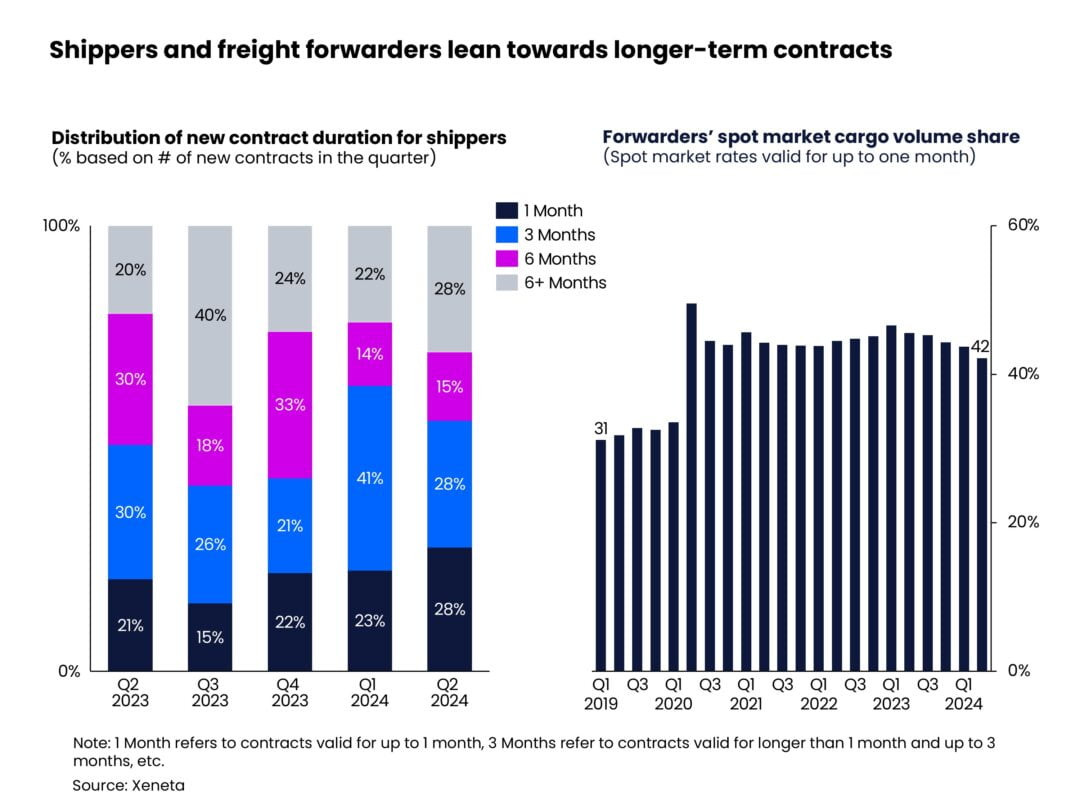

Given the market turbulence and the aptitude for an air cargo rate remark in Q4, shippers are all over all over again adjusting their preferred contract lengths.

Within the second quarter of 2024, contracts lasting more than six months topped the record, with an increasing share of 28%. Shippers are shifting in direction of contracts of six months or more to assign a long way off from the predicted rude freight rate fluctuations in some unspecified time in the future of the upcoming one year-end peak season.

The decrease in three-month contracts suggests unease amongst shippers about renegotiating charges gorgeous ahead of the one year-end peak season.

Freight forwarders appear to share the an identical survey, also procuring fewer cargo volumes within the space market. Within the second quarter of 2024, the proportion of cargo volumes procured within the space market accounted for 42% of the whole market, showing a -3% pts reduction versus a one year ago.

“As we head into the second half of the one year, it would per chance per chance presumably be now or by no methodology to steal into consideration longer-term contracts. With a mixture of ocean transport chaos, an upturn in manufacturing activities, and be concerned-of-missing-out, a mild balance of short and lengthy-term contracts is on every person’s solutions. Only time will account for, however no matter occurs, you’re going to be paying plan more to ship items from Asia Pacific as soon as September comes,” van de Wouw stated.