As present chain disruptions roam, the US East Hover and Gulf Hover port strike – which started this day – was as soon as one amongst the extra predictable. Threats to US port operations seesaw from one aspect of the country to the rather a lot of on a six-yearly cycle as collective labor contracts grind towards expiry dates and efforts to barter unique ones gallop on for months with out success.

Two years ago, uncertainty shrouded the West Hover, where the Pacific Maritime Affiliation (a firm representing employers within the transport replace) and the World Longshore and Warehouse Union (ILWU), representing 22,000 dockworkers, took larger than a three hundred and sixty five days to lastly hammer out a brand unique deal.

This time around, it’s the turn of the World Longshoremen’s Affiliation (ILA) and forty five,000 of its participants at ports equivalent to Recent York-Recent Jersey, Savannah, and Houston to rock the boat. ILA president Harold Daggett started warning of the prospect of a strike as a long way assist as November 2023 if bosses at the USA Maritime Alliance (USMX) didn’t meet the union’s query for a 77% pay rise.

“Known Known” dangers

In present chain threat phrases, US port strikes have change into what the frail Secretary of Defense Donald Rumsfeld famously generally known as a “identified identified.” Unlike “identified unknowns” or “unknown unknowns” (also known as “Dusky Swans”), these are threat events for which the timing and seemingly penalties are effectively understood and hence may perhaps additionally be planned for.

The “Rumsfeld Matrix”

While the actual duration and dollar impact of a port strike can’t be identified in method, old journey does present some pointers. The last West Hover strike in 2015 lasted eight days and value the Southern Californian economy alone an estimated $8 billion. The last East Hover strike in 1977 ran for 60 days with economic prices reckoned to be in intention over $1 billion per week nationwide. Backlogs, by approach to the collection of days’ extend in unloading ships per day of strike action, is also estimated with a inexpensive stage of accuracy.

Monetary losses will positively be greater this time around, if handiest resulting from inflation throughout the practically half-century since – although most likely no longer as dramatic because the $5 billion per day that JP Morgan has forecast. As for duration, Lee Klaskow, Bloomberg Intelligence Transportation and Logistics Analyst, anticipates a two-week strike at the 36 ports affected, with a “gallop on economic development” the principle impact. (Klaskow is presenting on the worldwide replace outlook to Zero100 participants subsequent week.)

One engrossing subject: container transport charges, which skyrocketed throughout the Covid-19 pandemic, are susceptible to be handiest “marginally affected” by the strike, according to replace experts.

Switching Cargoes From East to West

With the absolute smartest thing about prolonged lead instances, many US retail and manufacturing companies were readying themselves for port closures, delays, and backlogs on the Eastern seaboard since early 2024. Relief in January, gathered for a Zero100 roundtable, larger than a dozen logistics leaders were extra exasperated about the specter of an East Hover port strike than the specter of drone and missile strikes on ships within the Purple Sea.

At a convention-up session in March, the senior logistics director at one US attire and footwear firm stated that if talks between the ILA and USMX didn’t yield growth by the summer, it would originate up diverting shipments to the West Hover.

Re-routing ocean-dash goods to ports unaffected by capability strike action – along with constructing up inventories, importing seasonal items equivalent to Christmas vacation gifts early, and shifting top class and perishable products to airfreight – is what any proactive present chain threat and resilience technique would dictate.

It’s unsurprising, then, that in most modern months, the head 5 West Hover ports have considered their portion of container import site site visitors overtake that of the absolute perfect East Hover and Gulf Hover ports – a reversal of the topic in 2022-23 when industrial unrest loomed over the Western seaboard. Total tell at the Port of Los Angeles, let’s reveal, was as soon as up 17.4% three hundred and sixty five days on three hundred and sixty five days by August, when put next with a 13% decrease in 2023.

Automation? Not if It Displaces Jobs

Nonetheless, the West Hover ports’ advantage may be short-lived. One motive for here’s that East Hover and Gulf Hover ports are extra atmosphere friendly, according to the most modern Container Port Performance Index. This reveals that the head quartile of performers involves eight ports on the East and Gulf Coasts (including Recent York-Recent Jersey), whereas seven of the 11 North American ports within the backside quartile are on the West Hover (including LA/Lengthy Seaside). Nonetheless East Hover and Gulf Hover ports shouldn’t be too smug. Loyal as with the ILWU’s Luddite-love stance, the ILA continues to strongly withstand the introduction of most modern technology, equivalent to driverless autos, computerized cranes, and even semi-computerized gates at terminal entrances. Its simply-expired contract stipulated a joint committee with equal employer and union representation to approve the form of technology, and the ILA says it walked out of talks in June because it had evidence this was as soon as being flouted at some ports.

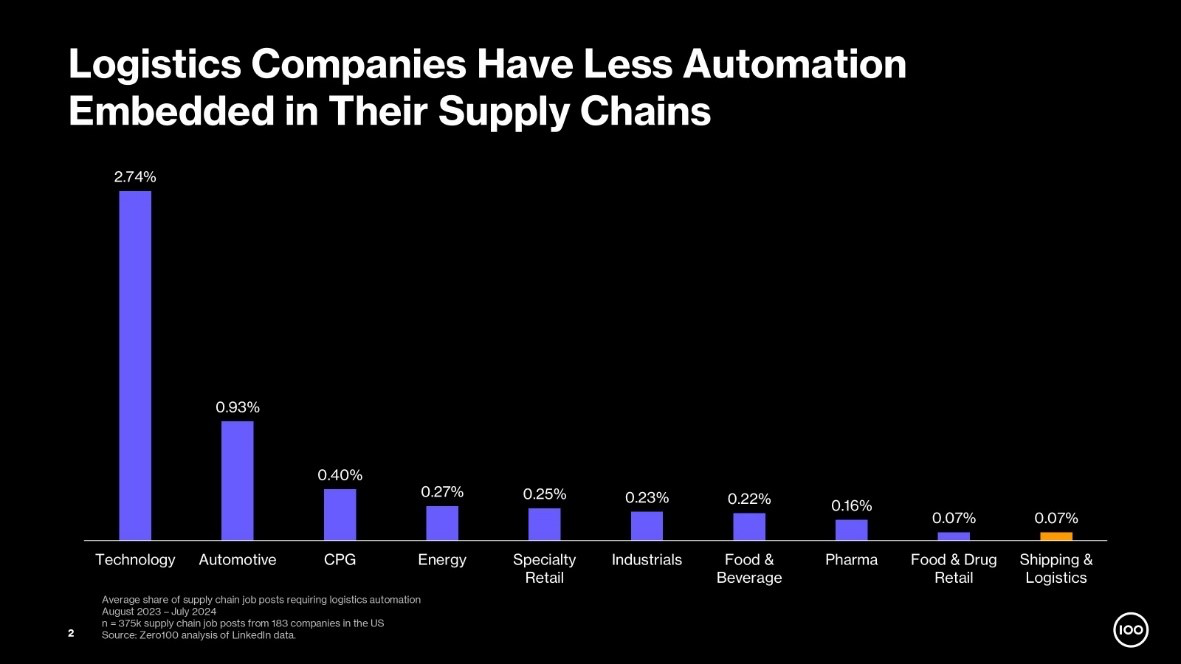

The inability of funding in productivity-bettering technology looks to be an replace-huge danger. Zero100 prognosis of present chain job postings by US companies between August 2023 and July 2024 reveals that transport and logistics companies lagged within the assist of their peers within the excessive-tech, automotive, CPG, and rather a lot of sectors in searching out for to search out workers equipped to handle a differ of computerized and self ample systems and self-utilizing autos.

The possibility of a brand unique prolonged-term agreement between the ILA and the USMX altering this dynamic seems to be as a long way-off as a lot of the ports from which US-dash shipments beget. And whereas the digitization subject stays unresolved, the cycle of predictable disruptions at US ports is determined to proceed.